If you want to learn how to become a filer, you are at the right place. Here, we will guide you on how you can do FBR registration and become a proud tax-paying Pakistani. Pakistan has very low tax-to-GDP ratios. This ratio tells you about the development of a country per year. The country will generate more revenue if it has high GDP (Gross Domestic Product). Hence, Pakistan is continuously trying to increase its tax base to a higher extent.

According to FBR (Federal Board of Revenue), out of 220 million, only 2200000 Pakistanis are active taxpayers. This quantity is no more than 1% of the total population. Nonetheless, the government is constantly trying its level best to do something about it. There are a plethora of changes done in FBR which will result in an increase in the number of active taxpaying Pakistanis.

What is Income Tax Return?

Income Tax Return is a form on which a person declares his income, details his expenses and also detail the increase or decrease in assets of a person for the year. Income Tax Return is filed with the Federal Board of Revenue through IRIS Online software. The deadline for Income Tax Return in Pakistan is normally 30 th September for the previous year but FBR has the power to extend the deadline date.

Table of Contents

These are the steps to follow in order to become a filer

Categorization of Pakistanis for Tax

Now things will get interesting, as we will talk about the categorization of citizens for Tax. The government has categorized Pakistanis into two groups. One category is for fillers and the other one is for non-fillers. If a person is a filer, he/she is an active taxpayer of Pakistan and is on the FBR list of active taxpayers. Whereas, those who don’t pay their taxes, are non-filers and are on the list of non-active taxpayers.

Active Taxpayer List or ATL is completely managed by FBR. It has the details of all of the tax-paying citizens and is updated on a weekly basis (on the first day of the week). The list can be downloaded from the FBR official website. You can then check your name in it. We will discuss checking your status on ATL later.

Criteria for Paying Tax

You must be wondering how do I know whether I have to pay the tax, do my FBR registration, and become a filer or not. There is a criterion for that. FBR has made six various tax slabs. People whose income is more than six laces per year have to pay their income tax. Those whose income is less than this amount don’t have to pay any tax. But, they do have to file a return to declare their income without paying taxes.

Advantages of becoming a Tax Filer

The government gives a lot of perks to tax filers as compared to non-filers so that more and more citizens can pay their taxes and become filers. Some of these benefits are as follows:

- Filers pay 50% less tax when buying immovable property in comparison to non-filers. It means non-filers have to pay more tax while purchasing a property.

- Non-filers have to pay more token tax in comparison to filers. It means if a non-filer has to pay 10000 for a vehicle token tax, a filer will pay 5000 or less vehicle token tax.

- Withholding tax for non-filers on a transaction of 50,000 or more is ).4% whereas for filers, it is 0.3%.

The process to Become a Filer

In order to become a filer, you need an NTN or National Tax Number from FBR. You also need to create an account on the official FBR site. Now, the question arises how to get an NTN number? Read on to find out how to do that.

Relevant Documents for NTN

You need the following documents for getting NTN:

- Contact Numbers (Landline and Mobile)

- Email address.

- Copy of valid CNIC

- Valid office and email address

- Copy of no more than 3 months old paid electricity bill of the house

- Copy of latest payslip

- NTN of Employer

- For business NTN, you have to tell about the nature of your business, have to attach property or rental papers and business letterhead.

Get Your NTN from FBR

Follow these steps to get your NTN from FBR:

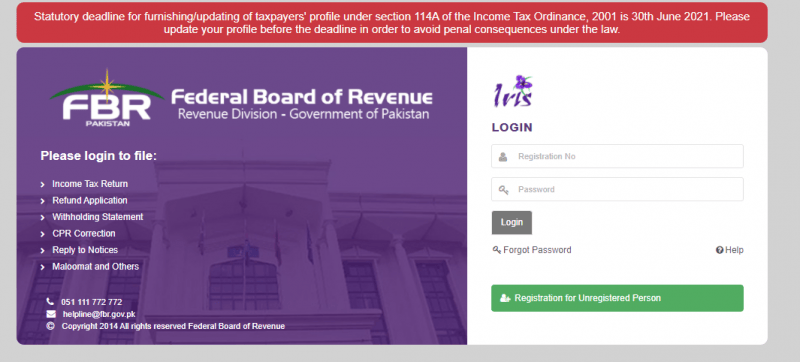

- First, you have to go to the FBR IRIS website https://iris.fbr.gov.pk/public/txplogin.xhtml

- Then, click on the option “registration for an unregistered person”.

-

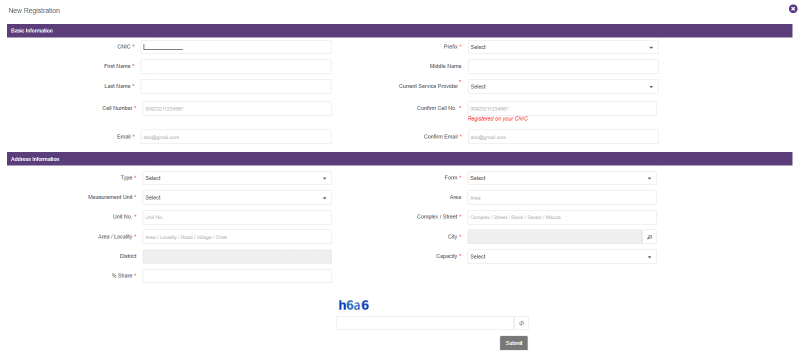

- After that enter all the required information and fill in all of the fields.

- After entering, click on submit.

- After submitting, you will receive two codes from FBR through email or SMS.

- Enter the codes and your account will be created. The username and password for your newly created account is sent to you through SMS or email. You can enter your username and password to log in to your account.

- Next, click on the draft and you will see a 181 application form. You have to click on the edit button so that you can enter your details for getting NTN.

- Now simply enter all the required information in the form and attach all the needed documents. Congratulations, you will get an NTN from FBR in a few hours.

After you get NTN from FBR, you have to go back to the FBR IRIS portal and follow the following procedure.

How to Become a Filer

When you are done with the FBR registration in the FBR system then you have to open the IRIS portal again with the following link

- You will see the same draft option in it. You have to edit the form.

- Enter the relevant information in the Bank Account tab, Personal Tab, Property Tab, Link Tab, and Business Tab. Attach the required documents as well. The entered information should be perfectly correct and should be of the current fiscal

- Then, click on the “submit” button and you are done with this long process.

- After that, you will receive a confirmation email from FBR. You will be added to the Active Taxpayer List (ATL).

You can also become a filer via the FBR offline system. For this method, you have to find a tax advisor to do the job for you and save your visits to the regional office of FBR. But it is a time and money-consuming option, so it is recommended to go for the online method.

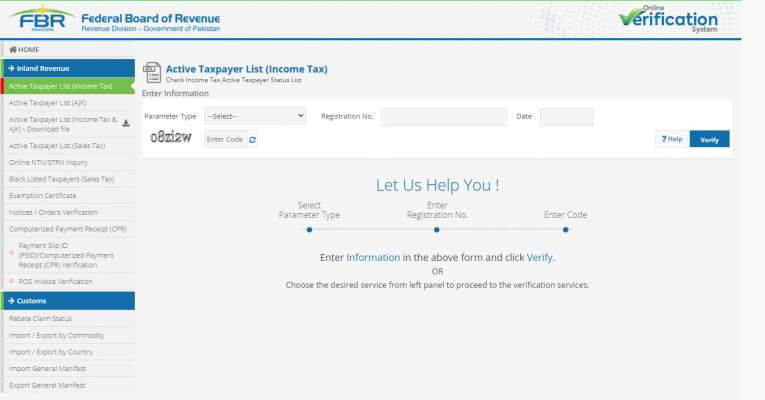

You can check your name in the ATL by downloading it from the FBR site. You can also check the status by SMS. You have to type ATL, space, your CNIC and send it to 9966. For checking the ATL status of your company or AOP, type ATL, space, NTN, and send it to 9966. There is also an online method of checking ATL status. Go to the website of FBR and verify your name in the ATL list by entering the required details in the fields.

These are some of the perks of being filer in Pakistan.

Paying tax is one of Citizens’ obligations, which are getting ignored due to lack of awareness. The Pakistani government has started to register filers online without any hassle of the queue, waiting, and other things to make it easier.

Conclusion

FBR registration is compulsory for every citizen of Pakistan if he/she fulfills the criteria of paying tax. People often don’t know how to become filer and help their country. We have provided you with the complete guide that will help you in registering yourself in FBR and becoming a filer. And of course, there are a plethora of benefits for filers. So, what are you waiting for? Register yourself in FBR now, be loyal to your country and enjoy the perks that come with it! For more information click here.

Hamza Subhan is a digital content director at Price In Pakistan. He lives in Lahore. He keeps an eye on every new item in the markets of Pakistan and his hand on the pulse of Pakistani people to provide them with the information that they need about the product. He has a bachelor’s degree in Electrical engineering from UET Lahore. His keen passion for the latest technology, gadgets, and knowledge about electrical appliances led him to launch Price In Pakistan. He is the main hand behind the articles related to electrical home appliances and gadgets. When he is not looking out for the new technology and writing about it, he is playing guitar and singing for his friends.