Guide on the Taxpayers to CDA Property Tax, Most homeowners in Pakistan and around the world have the daunting task of calculating and filing property tax which warrants a great deal of care and attention. To help homeowners in the capital of Pakistan; Islamabad, sort out their taxes and provide them with answers regarding their queries about the subject, we have brought a comprehensive guide on CDA property taxes.

CDA property tax bills are issued every year on or before 15th August. Property owners can contact the Directorate of Revenue for the Duplicate bill in case they haven’t received it or they can get it from the website CDA.

Table of Contents

Check out this amazing guide on the taxpayers to CDA Property Tax

For multi-unit buildings, bills are issued on a prorated basis.

Where are Payments of Property Tax Accepted?

Payments of Property Tax are accepted at various banks across Islamabad. You can pay the tax at:

- ABL I-8/3, I-9, I-10, I-11 (F&V Market), G-7, G-9, G-10, G-11, F-8, F-10, F-11

- Askari Bank (All branches located within the city of Islamabad)

- Bank of Khyber Jinnah Avenue

- FWB Jinnah Avenue, G-9, AIOU

- HBL Civic Centre, F-7, Jinnah Avenue

- MCB CDA (Sectt.)

- NIB Bank, Razia Sharif Plaza, F-7/G-7

- UBL Civic Centre, Aabpara, F-6, G-8 Markaz

You can also pay the tax through Pay Order/ Local cheques in Favour of Director Revenue, CDA.

Can I Pay CDA Property Tax Bill Online?

In line with the Government of Pakistan’s Ease of Doing Business reforms, the CDA has collaborated with various commercial banks to provide the residents of Islamabad with the facility of paying their property taxes, and water and allied charges online through the easy process.

Presently, only the account holder of Muslim Commercial Bank can Pay their CDA property tax bill online via MCB Internet Banking. However, this facility will be soon available to the account holders of other leading commercial banks.

How to Access CDA Property Tax Bill Online?

You can visit the CDA website to get a duplicate of your latest CDA property tax bill. To access your bill online, hover over the “E-Services” tab at the top and click on “Property Tax Bill” in the drop-down menu that appears. You will be redirected to a new webpage where you can enter your 10-digit consumer number in the field and click the “Submit” button.

How Much Rebate is Allowed on Payment of Current Tax?

5% rebate has been allowed on payment of current tax up to 30 September. You can pay a non-waivable surcharge @ 1.5% per year on the outstanding tax after the expiry of the financial year.

How to Get a “No Demand Certificate”?

A “No Demand Certificate” will be issued on the request of the attorney/owner after the verification of the actual area covered as per site and after the payment of this tax as well as arrears, if any, in the form of pay order to DIrector, Revenue, CDA.

Are There Any Exemptions or Concessions to This Tax?

There are some exemptions to this tax which are subject to the production of the declaration on simple paper or notarized affidavit for each respective year by the owner, duly attested by CDA Magistrate, Director Revenue, Directory Law, Dy. Director Revenue, Director Estate Management-I & II, or any Government Officer of Grade 17 or above.

Specimens of the declaration/affidavit may be obtained from the Directorate.

Following are the exemptions/concessions to this tax.

- 50% concessions in the tax on one residential house, apartment, or flat owned and self-occupied (not self-hiring) by the allottee/owner or his family including his parents.

- 100% exemption (up to plot area 240 yds) from this tax on one residential house, apartment or flat owned by a widow if she doesn’t own any other built-up property anywhere in Pakistan. This exemption is also available to the minor sons and unmarried daughters of a widow after her death.

- 75% concessions in this tax on one residential house, apartment, or flat owned and occupied (not on self-hiring) by a retired government employee whether in his/her own name or jointly with or in the name of his/her spouse or dependent children. This exemption is only applicable if this is his/her/their only property in Pakistan and he/she/they are living by themselves in that house, apartment, or flat as the case may be. In case of death of the retired government employee, this exemption is also available to the surviving spouse or the minor dependent children of the deceased employee.

- Self Occupation rebate of (a&c) is allowed only on current dues and arrear of last one year.

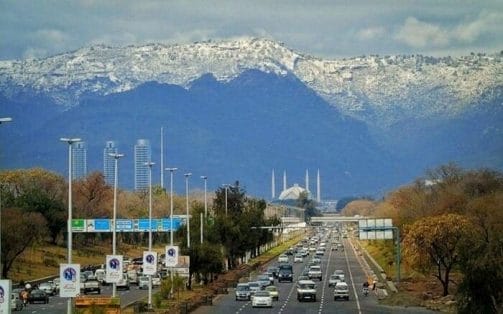

What is The Capital Development Authority?

Capital Development Authority (CDA) is the main civic authority overseeing maintenance, building, and town planning in Islamabad. The CDA Ordinance 1960 has defined the duties and the authority of the Capital Development Authority. Just like Rawalpindi Development Authority in Rawalpindi and Lahore Development Authority in Lahore, Capital Development Authority is also responsible for ensuring cleanliness, municipality, provision of goods, and providing quality education and health services to the residents of the city.

Moreover, CDA works with other local authorities such as the ICT Administration and Metropolitan Corporation Islamabad to ensure consistency in the expansion and development of the meticulously planned metropolis.

It is important to note here that CDA has digitized its various key public services such as the Urban Land Record System and has brought an efficient system of online payment of dues to promote the system of e-governance.

Here you have a comprehensive guide on CDA property tax 2021. To learn more about the CDA property tax and find answers to your issues, you can contact the authority. For more information click here.

Hamza Subhan is a digital content director at Price In Pakistan. He lives in Lahore. He keeps an eye on every new item in the markets of Pakistan and his hand on the pulse of Pakistani people to provide them with the information that they need about the product. He has a bachelor’s degree in Electrical engineering from UET Lahore. His keen passion for the latest technology, gadgets, and knowledge about electrical appliances led him to launch Price In Pakistan. He is the main hand behind the articles related to electrical home appliances and gadgets. When he is not looking out for the new technology and writing about it, he is playing guitar and singing for his friends.